0

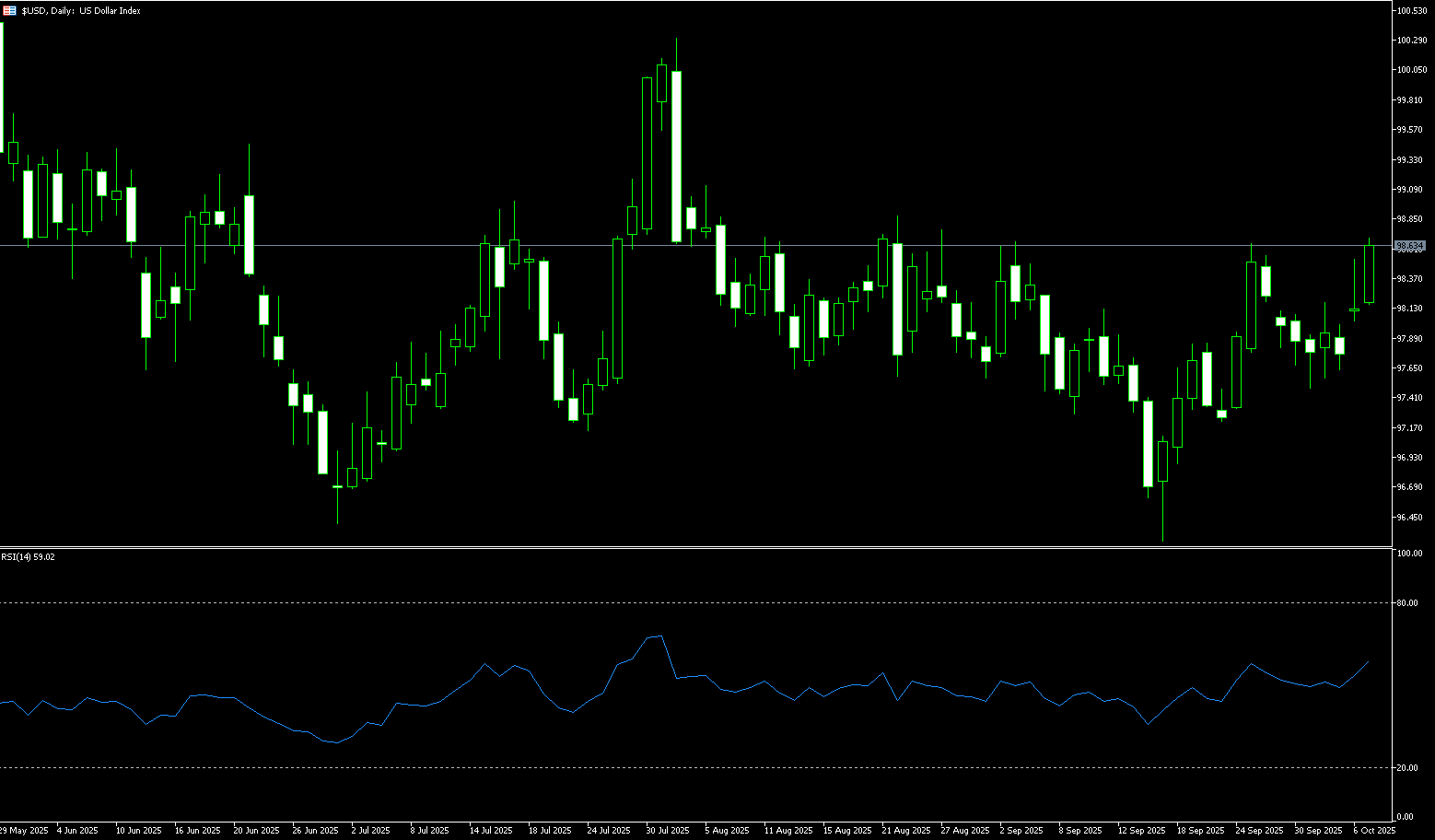

US Dollar Index

The US dollar index rebounded to around 98.60 on Tuesday, extending gains from the previous session as the government shutdown entered its seventh day with Democrats and Republicans in the Senate unable to reach an agreement on a funding bill. Democratic Leader Chuck Schumer also dismissed President Donald Trump's claims of negotiations with Democrats. On the policy front, recent data has reinforced expectations for a Federal Reserve rate cut, with the market almost fully pricing in a quarter-point rate cut this month and another in December. Traders now await the latest cues from central bank officials this week, including speeches by Fed Governor Stephen Milan on Wednesday and Chairman Jerome Powell on Thursday. The dollar also found support from weakness in the euro and yen following the resignation of the new French government and the election of a dovish leader by Japan's ruling party.

The daily chart shows that dollar bulls broke through Monday's high of 98.50 and the upper Bollinger Band level of 98.52 yesterday. A sustained hold above this level could reopen the upside towards 98.71 (the 61.8% Fibonacci retracement level from 100.26 to 96.22) and 99.00 (the round-figure mark). However, failure to hold would further strengthen resistance near these highs. Currently, fiscal uncertainty in Japan and Europe is supporting the dollar, but transparency in US economic data is decreasing. Therefore, market sentiment at 98.00 is likely to determine the market tone before the close of this week. A break below this level would signal a shift in market tone, potentially pushing the market towards last week's low of 97.46. The September 23rd swing low at 97.21 and the 23.6% Fibonacci retracement level from 100.26 to 96.22 at 97.17 also provide further support.

Consider shorting the US Dollar Index at 98.75 today, with a stop-loss at 98.88 and targets at 98.30 and 98.20.

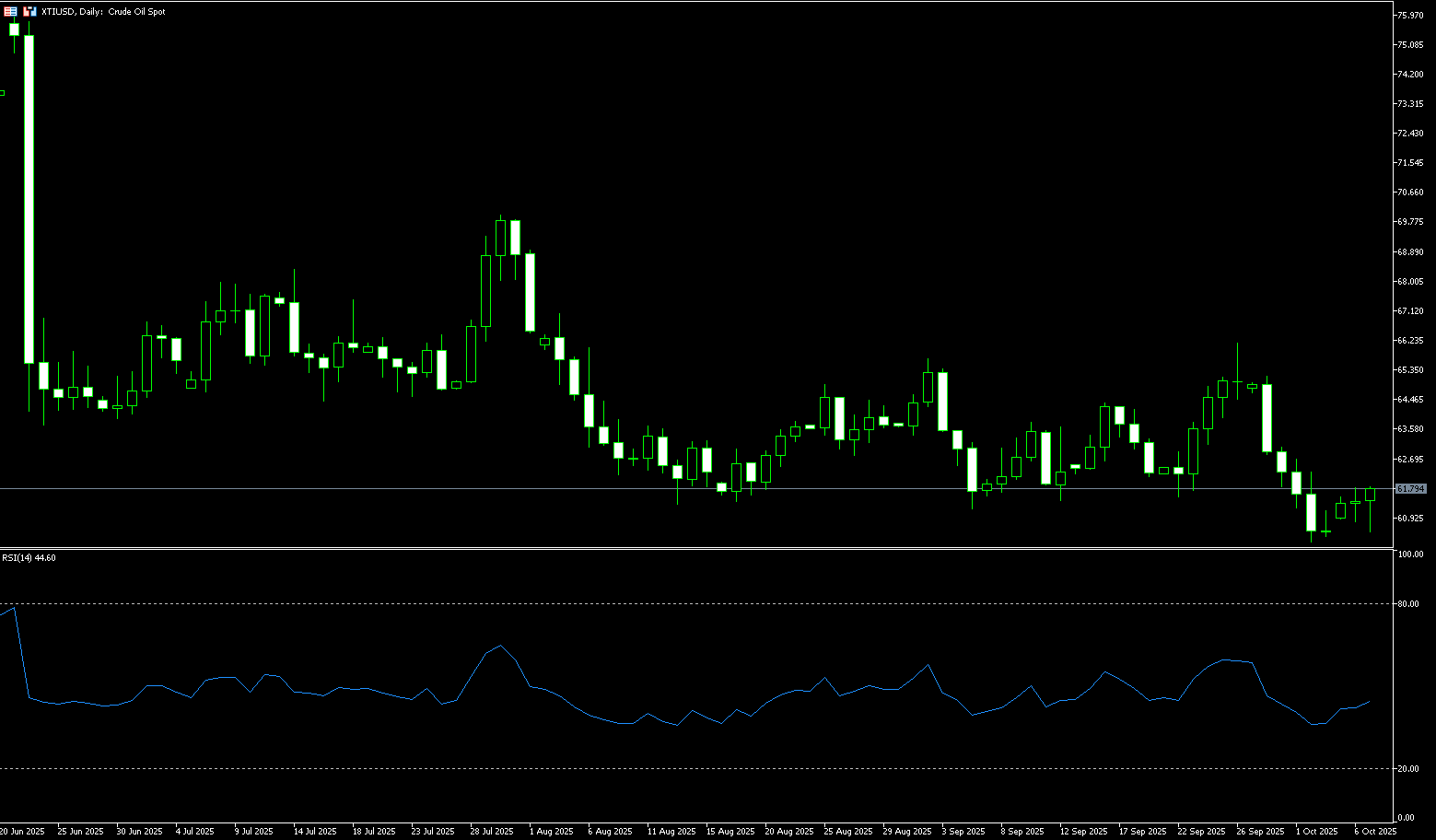

WTI Spot Crude Oil

In early Asian trading on Tuesday, US crude oil traded around $61.60 per barrel. Oil prices rose at the start of the week as OPEC+ production increases were smaller than expected, easing some concerns about rising supply. Over the past two trading days, US crude oil prices have rebounded slightly by approximately 1.5%, signaling a renewed buying bias in the market. This shift is primarily driven by OPEC+'s recent comments last weekend, which suggested a potential supply glut may not materialize in the coming months. As long as the current moderate supply outlook holds, market concerns about potential overcapacity are expected to continue to ease, providing stronger support for oil prices in the short term. The CBOE Volatility Index (VIX) has been climbing recently and is currently approaching the 40 mark, indicating a steady increase in implied volatility. This suggests heightened market uncertainty about the oil price outlook and a significantly increased likelihood of significant short-term price fluctuations.

Recent technical analysis reveals that strong selling pressure pushed oil prices to a low support level of $60.22, the lowest level since October, during several trading days in late September. However, prices subsequently rebounded significantly, temporarily halting the downward trend. If selling pressure fails to regain momentum, a neutral market structure may emerge in the short term. The 14-day Relative Strength Index (RSI) on the daily chart continues to fluctuate below 50, indicating that market sentiment remains bearish. However, the indicator's recent positive slope suggests that price action may be gradually transitioning towards neutrality. Near-term support areas include $61.17 (the 5-day moving average), followed by $60.22 (last week's low), and $60.19 (the lower Bollinger Band line). Above this, $62.80 (the Bollinger Band's middle axis) and $63.41 (the 50-day moving average) constitute key hurdles for bulls. A successful break above these levels could signal a stronger bullish structure.

Consider going long on crude oil at 61.60 today. Stop-loss: 61.40, target: 63.20, 63.50.

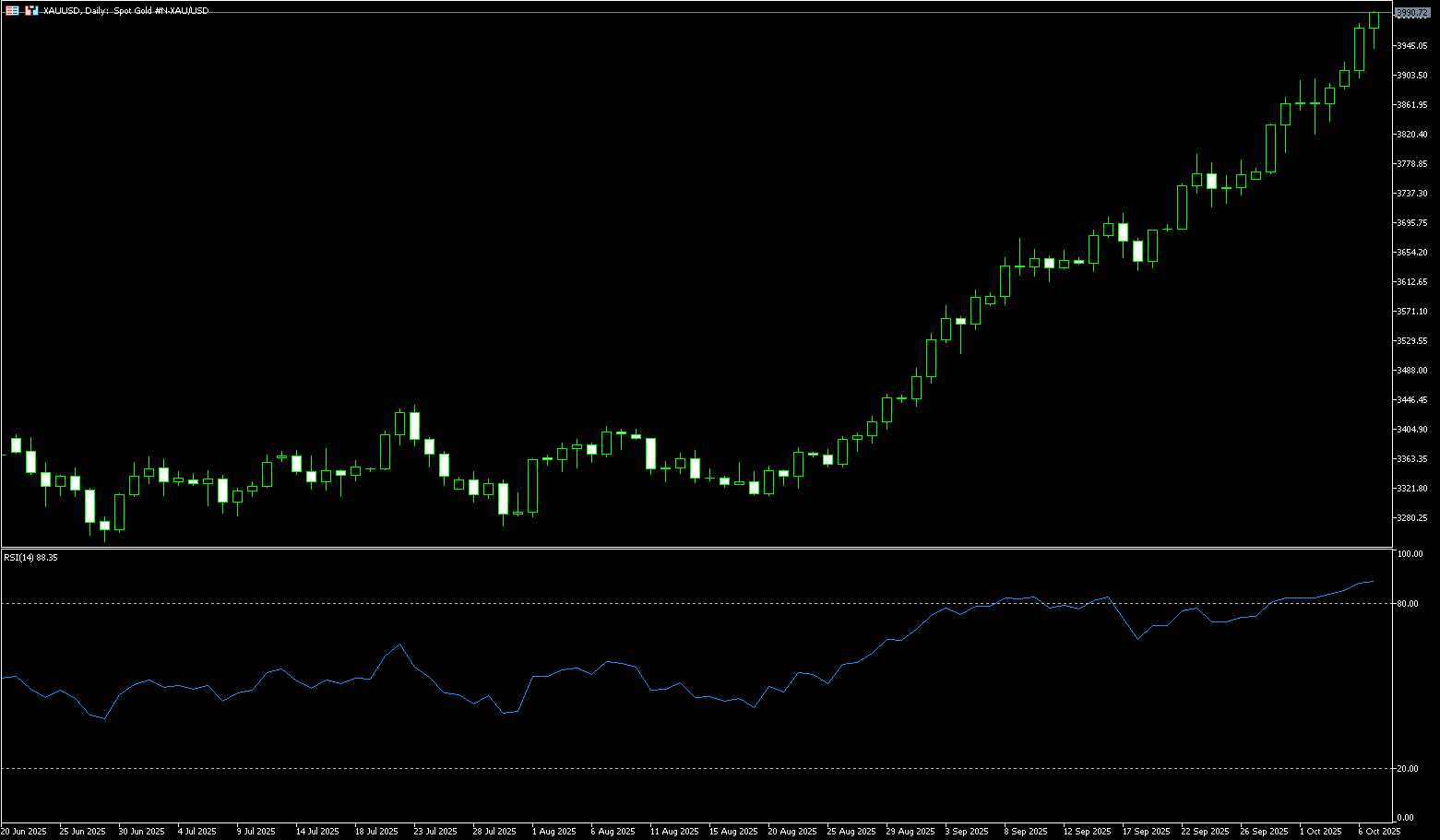

Spot Gold

On Tuesday, spot gold traded around $3,980/oz. Gold prices hit two new all-time highs this week, reaching $3,991/oz, buoyed by growing expectations of a Federal Reserve rate cut this month and economic and political uncertainty in the United States, France, and Japan. Political developments in France, rising Japanese government bond yields due to inflation concerns, and the ongoing US government shutdown all contributed to gold's surge. Supported by expectations of a Fed rate cut, continued central bank purchases, continued safe-haven demand, and a broadly weakening US dollar, gold has climbed 50% year-to-date, reaching new all-time highs. Spot gold prices first broke through $3,000/oz in March and surpassed $3,800/oz at the end of September. In a low-interest-rate environment and economic uncertainty, non-yielding gold is popular. Gold prices have reason to rebound further due to both fundamentals and momentum, and are now expected to reach $4,200/oz by the end of the year.

Gold's approach to $4,000 is a result of the interplay of expectations of a Federal Reserve rate cut and global political and economic turmoil. This rally not only reflects investor risk aversion but also highlights gold's core value in turbulent times. The current daily chart shows gold prices advancing unilaterally along the upper Bollinger Band at $3,972, with a significant widening of the band, reflecting the rising volatility following a trend of increasing volume. Prices have repeatedly traded close to the upper band, a typical example of a "track-to-track rally." A new high of $3,991 has been reached, indicating continued buying activity. Key levels of $3,900.00 and $3,864 (Monday's low) have transitioned from resistance to support, representing potential defensive levels for a near-term "retracement and retest." If gold prices break through $3,991.00, a new all-time high will be reached. The first resistance level will be the psychological $4,000 level, followed by the $4,050 level.

Consider going long on gold today at $3,975, stop-loss at $3,970, target at $4,000, 4.020.

AUD/USD

AUD/USD weakened slightly on Tuesday, giving back some of the previous day's gains. The pair depreciated following the release of October Westpac Consumer Confidence and September ANZ job advertisements. Despite the increased likelihood of further Fed rate cuts and the ongoing government shutdown, the US dollar remained supported. At its September monetary policy meeting, the Reserve Bank of Australia (RBA) decided to maintain the official cash rate at 3.6%. The RBA warned that inflation has been more persistent than expected, particularly in the services sector, while the labor market remains tight. Traders this week will likely monitor speeches by Reserve Bank of Australia (RBA) officials, which are expected to provide further insight into the central bank's policy outlook following the latest inflation data.

AUD/USD traded below $0.6600 on Tuesday. Technical analysis on the daily chart suggests the pair remains in an uptrend, indicating a bullish bias. Furthermore, the 14-day Relative Strength Index (RSI) is above 50, further strengthening the bullish bias. On the upside, AUD/USD could initially test 0.6660 (the high of September 18). If bulls break resistance at 0.6660, it could head towards the 0.6700 round-number mark and the 12-month high of 0.6707 reached on September 17. Initial support lies at the psychological level of 0.6576 (the lower Bollinger Band). Further declines would lead to support at 0.6520 (the low of September 26), which aligns with the upper round-number mark near 0.6500.

Consider going long on the Australian dollar at 0.6570 today, with a stop-loss at 0.6560 and targets at 0.6630 and 0.6640.

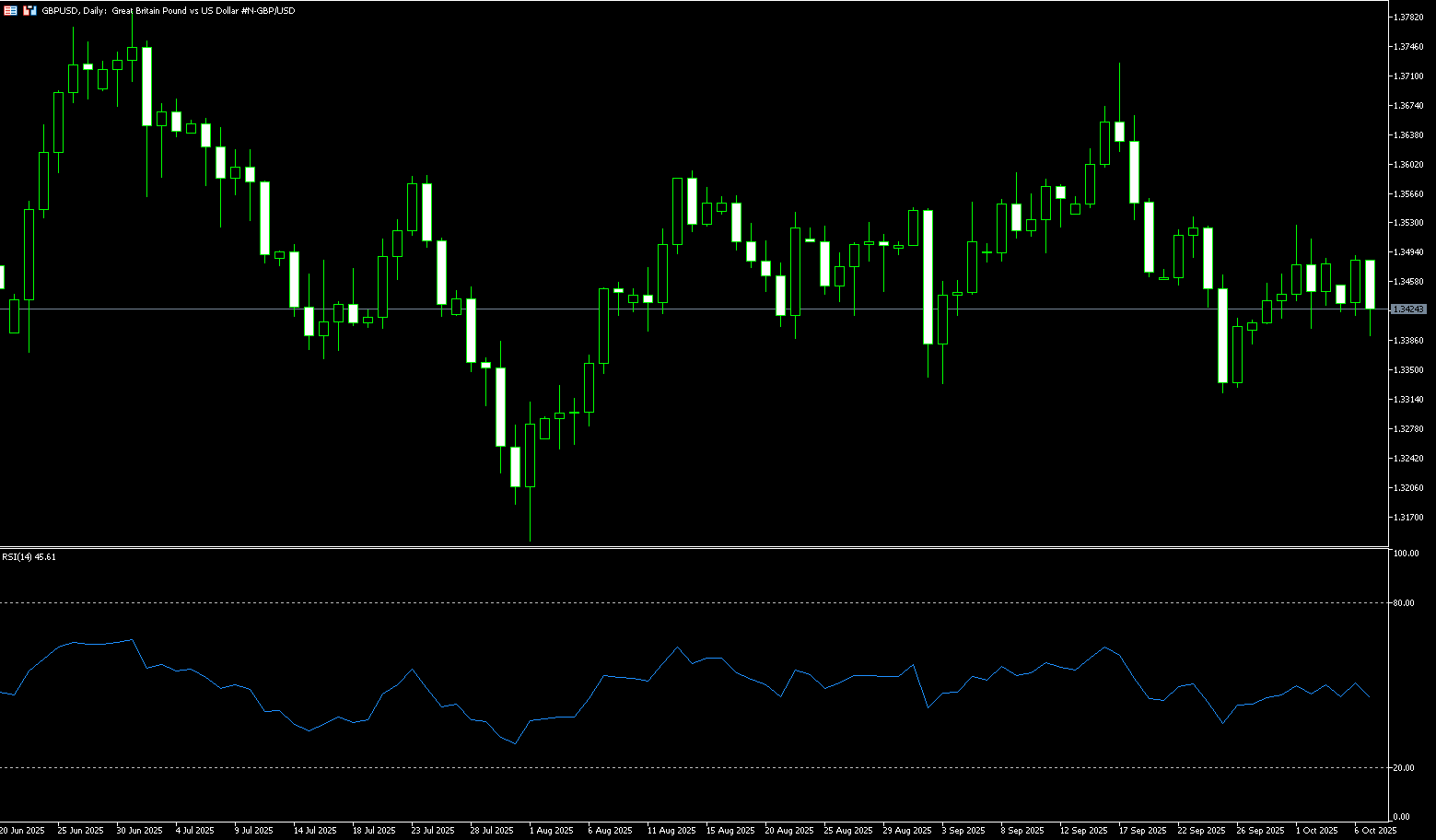

GBP/USD

During Tuesday's European trading session, the British pound (GBP) fell against the US dollar, approaching 1.3430. Political unrest in Japan and France increased safe-haven demand for the US dollar, leading to a sharp decline in GBP/USD. Overall, the Federal Reserve's resolute dovish stance and the ongoing US government shutdown are expected to limit the dollar's upside. The Fed's dovish stance has increased due to weak labor market conditions and stable consumer inflation expectations. For fresh clues on the Fed's outlook, investors are awaiting speeches from several Fed officials: Atlanta Fed President Raphael Bostic, Fed Governors Michelle Bowman and Stephen Milan, and Minneapolis Fed President Neel Kashkari are all scheduled to speak during Tuesday's North American trading session. Due to the government shutdown, investors are eager to understand the current state of the US labor market, given the lack of key economic data releases.

On Tuesday, the British pound fell against the US dollar, approaching the 1.3400 round-figure mark. GBP/USD is currently struggling above its 9-day simple moving average, which is trading around 1.3437. The 14-day Relative Strength Index (RSI) on the daily chart is fluctuating between 40.00 and 50.00. This suggests that the GBP rally has room to extend, but a significant break above 1.3527 (last week's high) is unlikely. In the short term, GBP is expected to continue trading in the 1.3400-1.3527 range. On the downside, the 1.3400 round-number mark will serve as key support. A break below this level would target the 150-day simple moving average at 1.3377, which will serve as key support. The September 25 low of 1.3324 will serve as short-term support. On the upside, Monday's high of 1.3490 and the psychological level of 1.3500 will serve as key resistance, with the next level targeting 1.3527 (last week's high).

Consider a long position on the British pound at 1.3410 today, with a stop loss of 1.3400 and targets of 1.3470 and 1.3480.

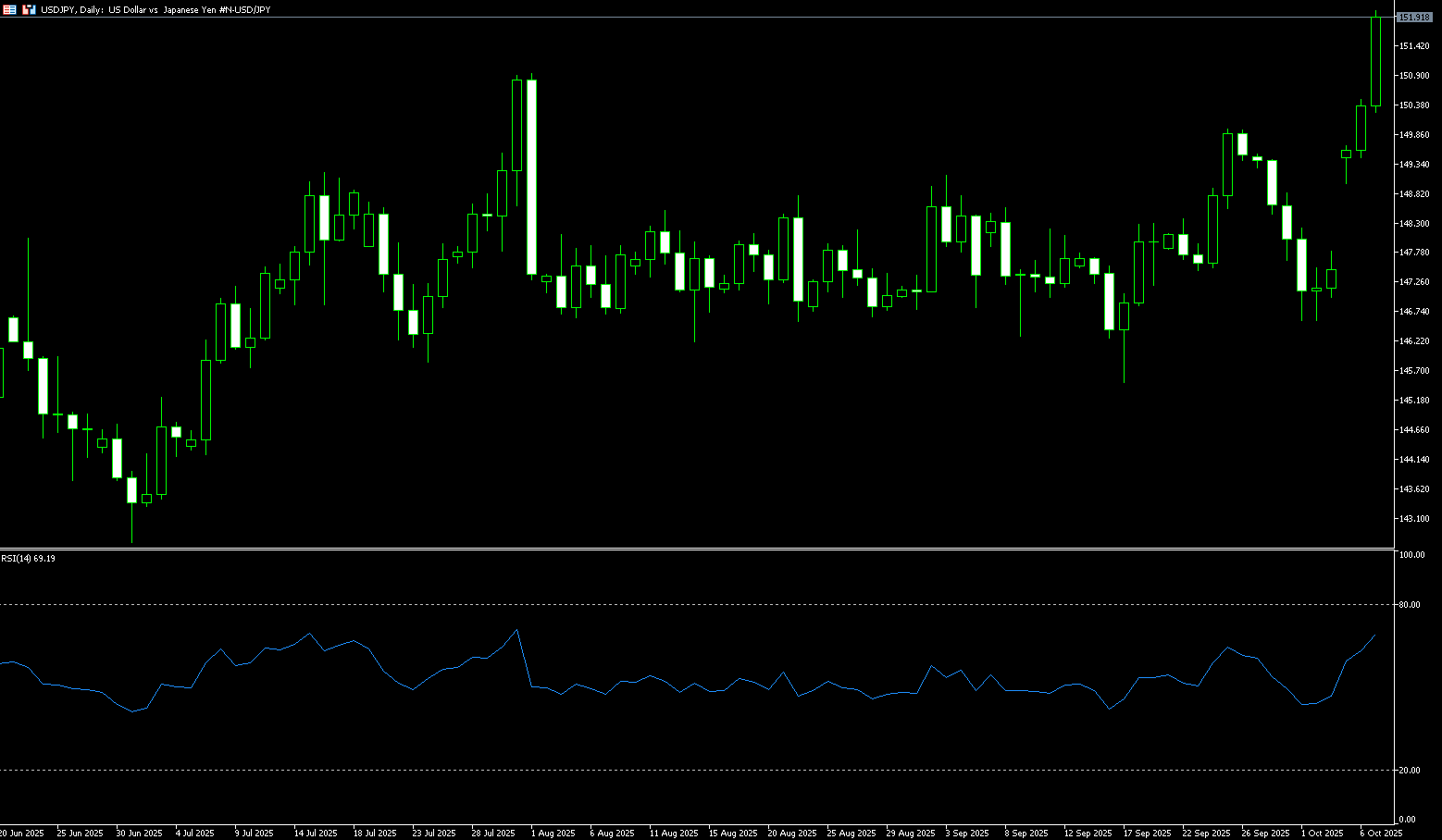

USD/JPY

USD/JPY rose to around 152.04 on Tuesday, its highest level since February. The yen weakened against the dollar amid concerns about political stability as Japan's ruling Liberal Democratic Party elected a new leader. Sanae Takaichi, a 64-year-old woman who is expected to become Japan's first female prime minister, won. Her victory led traders to reduce bets on a Bank of Japan rate hike this month, putting pressure on the yen and creating a tailwind for the currency pair. Takaichi's unexpected victory in the LDP leadership election marks a significant turning point in Japan's policy and market outlook, pushing the next Bank of Japan rate hike to December instead of October. Traders awaited signs of a reopening of the US federal government, as the shutdown has left a gap in US economic data. Concerns about a prolonged government shutdown could weaken the dollar against the yen in the short term.

The Bank of Japan saw significant declines at the start of the week as market participants digested the latest political developments in Japan. The election of Sanae Takaichi as the new leader and her pro-stimulus policy stance weighed on the yen, causing it to fall nearly 2% from Friday's close. Market participants reacted strongly to the potential reintroduction of fiscal stimulus and potential opposition to the Bank of Japan's tightening policy plans. In the short term, USD/JPY saw some position-squaring following its gains. Daily momentum has stabilized, while the 14-day relative strength index (RSI) has risen. Risk is tilted to the upside in the short term. Resistance lies at 152.39 (February 14 high) and 153.00 (round-number level). Support lies at 150.92 (August high) and 150.00 (psychological level). Given the uncertainty, USD/JPY is likely to continue its upward trend in the short term unless the US dollar weakens significantly.

Consider shorting the US dollar at 152.30 today. Stop loss: 152.50, target: 151.30, 151.10.

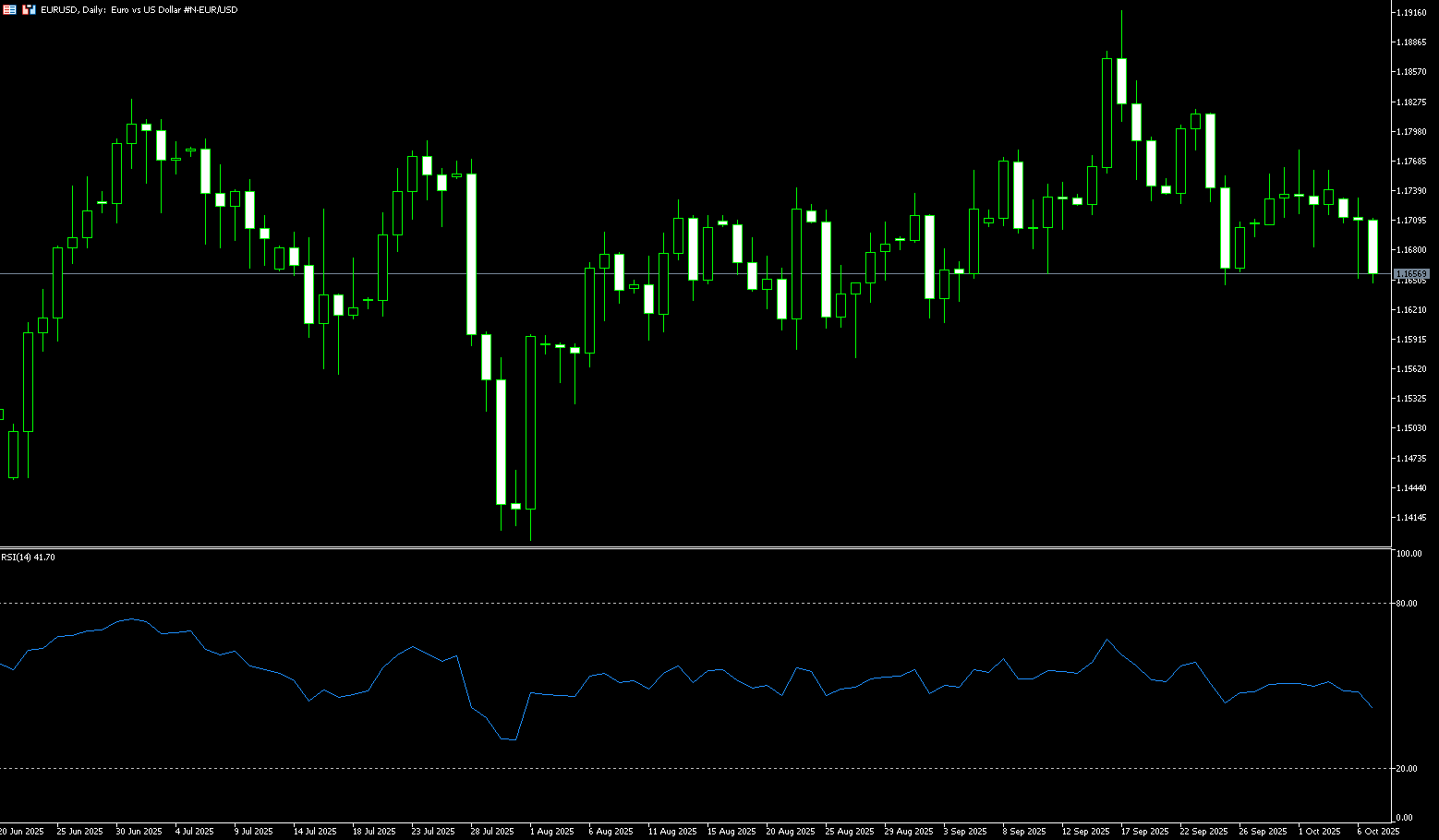

EUR/USD

The euro slipped to $1.1645 against the dollar, its lowest level since September 25th, dragged down by renewed political uncertainty in France and the continued lack of progress in the US government shutdown. In France, Prime Minister Sebastien Le Cornu submitted his resignation on Monday, despite President Emmanuel Macron's call for continued negotiations to break the political deadlock on Wednesday evening. Betting markets now see an almost 60% probability of a snap election this month, although it's unclear whether such a move would resolve the impasse. On the data front, German factory orders fell 0.8% in August, missing expectations for a 1.4% increase and marking the fourth consecutive month of decline. Meanwhile, France's trade deficit narrowed less than expected, with solid exports offset by a larger decline in imports.

EUR/USD is facing renewed bearish pressure amid a risk-off market, with prices approaching monthly lows in the 1.1645 area. The 8-hour Relative Strength Index (RSI) has consolidated below the key 50 level, highlighting bearish momentum, while the Moving Average Convergence Divergence (MACD) remains below its signal line, suggesting the possibility of further depreciation. A confirmed break below the aforementioned 1.1645 area (October 7 low) would pave the way for further gains against the lows of September 2 and 3 (near 1.1610) and the lows of August 22 and 27 (near 1.1575). Upward attempts could be challenged at the 1.1700 (round number), followed by last week's high in the 1.1778 area and the highs of September 23 and 24 (near 1.1820).

Today, you can consider going long on EUR at 1.1640, stop loss: 1.1630, target: 1.1690; 1.1700

Disclaimer: The information contained herein (1) is proprietary to BCR and/or its content providers; (2) may not be copied or distributed; (3) is not warranted to be accurate, complete or timely; and, (4) does not constitute advice or a recommendation by BCR or its content providers in respect of the investment in financial instruments. Neither BCR or its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

Lebih Liputan

Pendedahan Risiko:Instrumen derivatif diniagakan di luar bursa dengan margin, yang bermakna ia membawa tahap risiko yang tinggi dan terdapat kemungkinan anda boleh kehilangan seluruh pelaburan anda. Produk-produk ini tidak sesuai untuk semua pelabur. Pastikan anda memahami sepenuhnya risiko dan pertimbangkan dengan teliti keadaan kewangan dan pengalaman dagangan anda sebelum berdagang. Cari nasihat kewangan bebas jika perlu sebelum membuka akaun dengan BCR.