0

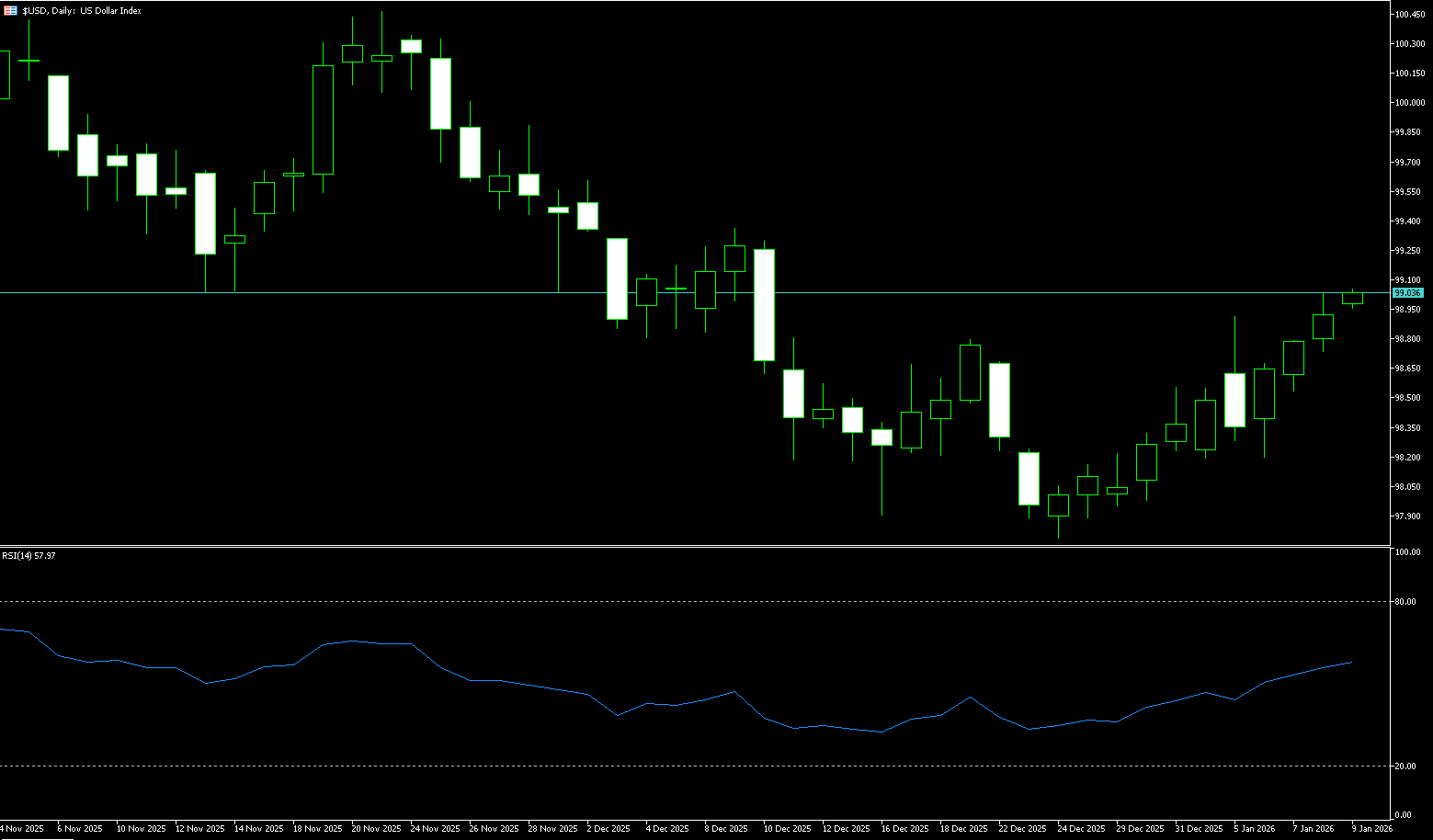

US Dollar Index

The US dollar strengthened to around 99.50, its highest level in about seven weeks. New data reinforced the view that the US economy remains strong, easing pressure on the Federal Reserve to cut interest rates quickly. Weekly jobless claims were significantly lower than expected, confirming that layoffs remain limited and the labor market remains resilient despite persistently high borrowing costs. This eased concerns that the Fed needs to accelerate rate cuts to support employment, weakening the arguments of more dovish policymakers. Meanwhile, President Trump stated that despite threats of prosecution from the Justice Department, he has no plans to fire Fed Chairman Powell. The market widely expects the central bank to keep interest rates unchanged later this month, with two rate cuts anticipated starting in June. Furthermore, Trump indicated he might postpone action against Iran while signing trade measures on key minerals and artificial intelligence chips.

The daily chart shows the US dollar index itself consolidating at high levels, currently trading around 99.35. The dollar's movement is influenced by two opposing forces: on one hand, safe-haven inflows due to geopolitical risks, and on the other hand, cautious market sentiment ahead of key data releases. Other major currencies, such as the euro, saw relatively limited volatility as the market awaited direction from US data. On the upside resistance front, the first level to watch is 99.50 (Thursday's high), followed by a potential further acceleration towards 99.82 (the high from November 28th last year). On the downside, support can be considered at the 200-day simple moving average of 98.72; a break below this level would target 98.50 (the 20-day simple moving average).

Today, consider shorting the US dollar index near 99.50; stop-loss: 99.60; target: 99.00; 98.90

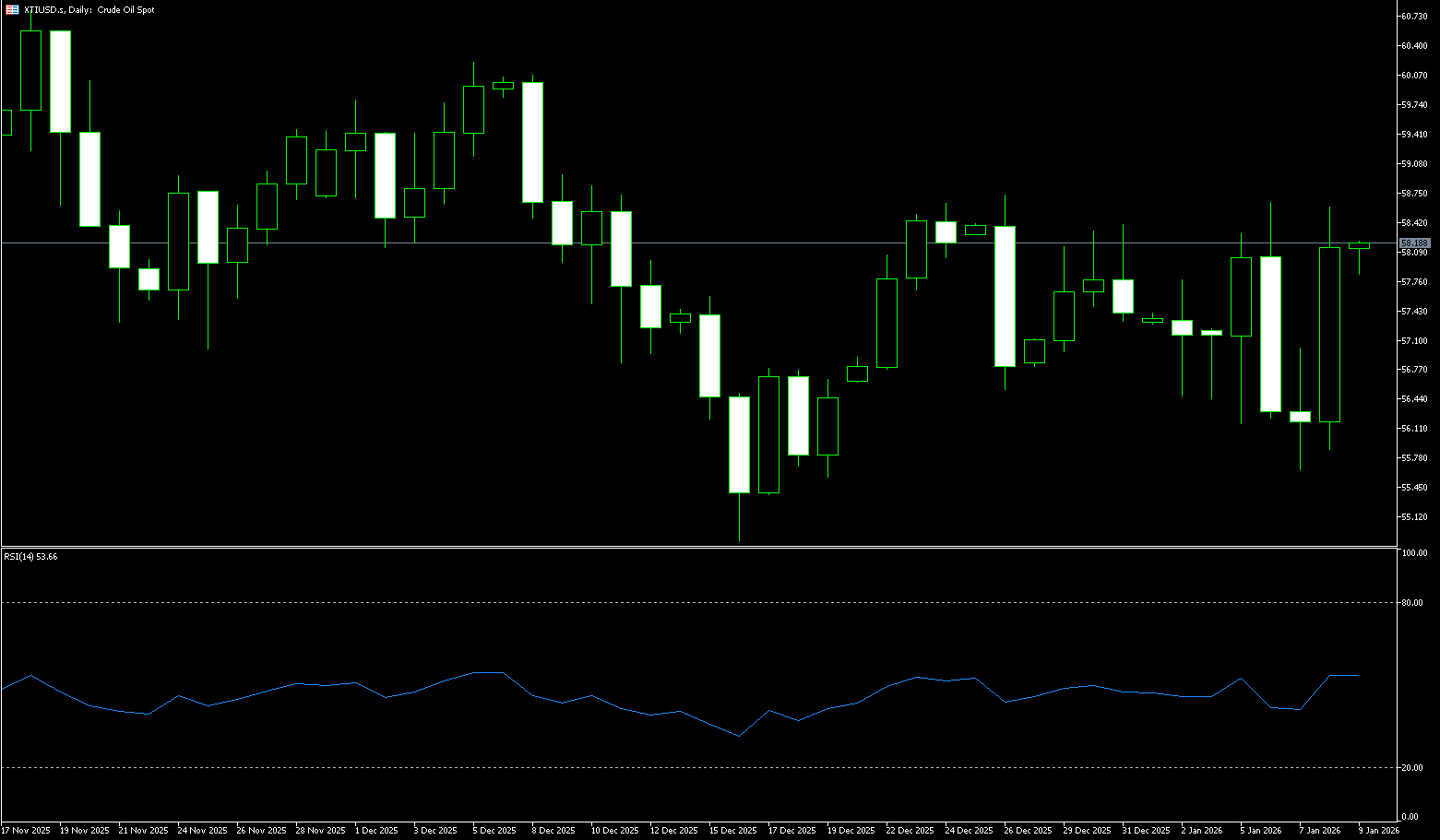

WTI Crude Oil

International oil prices experienced a technical pullback after a significant overnight surge. Currently, WTI crude oil is trading around $59 per barrel, down approximately 2% on the day. This rally was primarily driven by escalating geopolitical risks in the Middle East. Fundamentally, the situation in Iran is the most crucial driving factor. Iran has warned its neighbors in the region that it will attack US military bases in those countries if the US launches a strike. This statement has pushed regional tensions to a new critical point. Meanwhile, diplomatic sources revealed that some personnel have been advised to evacuate from the main US airbase in Qatar. Although there has been no large-scale troop movement yet, market concerns about supply disruptions have significantly intensified. Recent tough rhetoric from former US President Trump, including threats to impose tariffs on countries doing business with Iran, has further exacerbated market uncertainty. This "economic confrontation" has been listed as a primary global risk by a well-known institution, and its impact is rapidly spreading through the energy market.

From a daily chart perspective, WTI crude oil has shown increased momentum after breaking through the recent psychological barrier of $60.00 this week. For US crude oil, the $60/barrel level is a crucial point that bulls must overcome, with the key resistance level above at the 200-day simple moving average of $61.98. Support lies around $57.93/barrel (the Bollinger Band midline); a break below this level would target $56.19 (the low of the 5th of this month). Closely monitor any news regarding US military movements or easing tensions in Iran, as any escalation or de-escalation could trigger significant two-way volatility in oil prices. Traders should also be wary that if the situation doesn't escalate into actual conflict, the rapidly accumulating risk premium may face selling pressure.

Consider going long on spot crude oil around $58.80 today; Stop loss: $58.60; Target: $60.30; $60.50

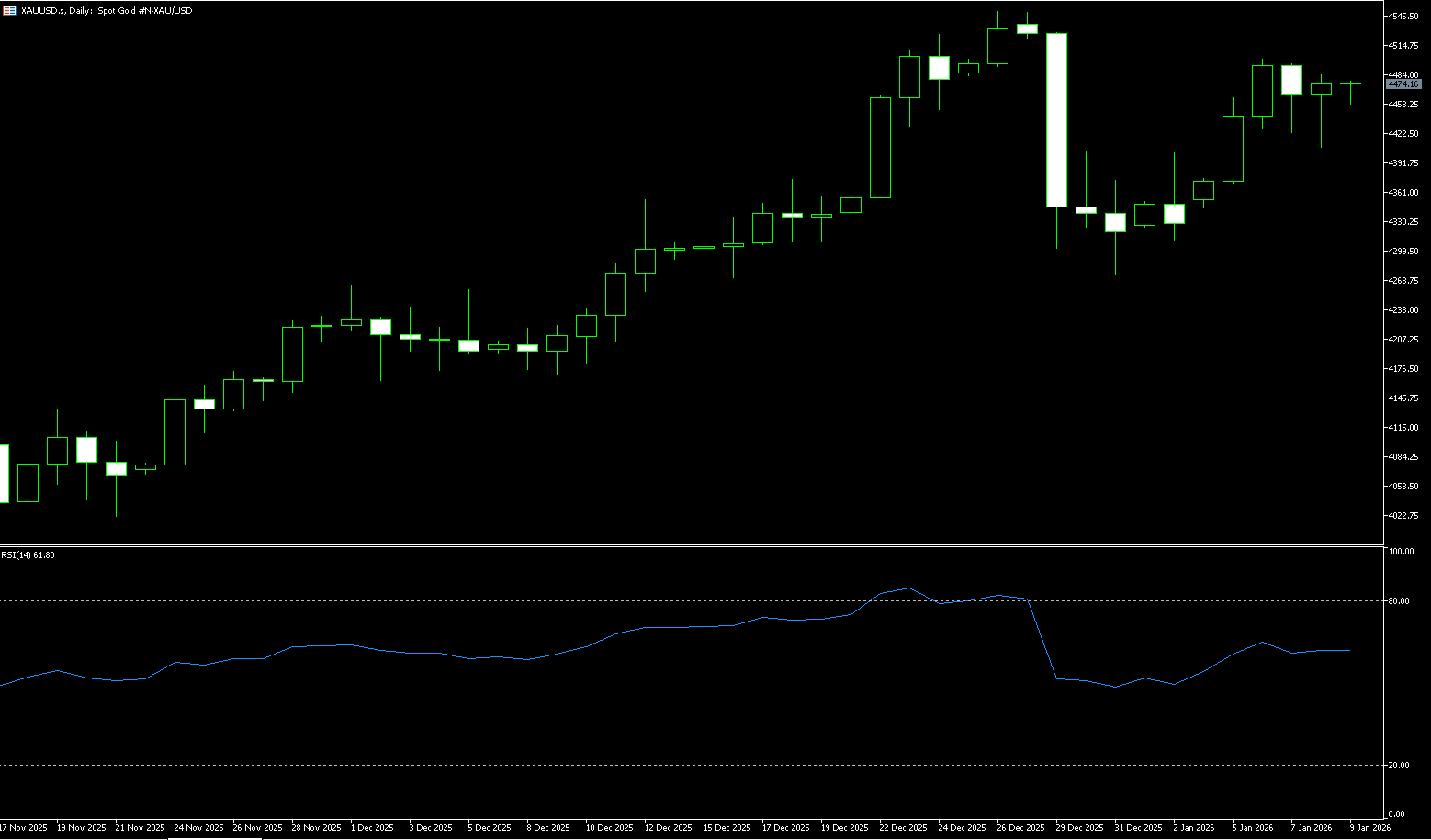

Spot Gold

The precious metals market shone brightly this week, with both spot gold and silver prices surging to record highs. Spot gold is currently trading at $4612/ounce. Firstly, escalating geopolitical risks, such as those in the Middle East and the Russia-Ukraine conflict, have spurred strong demand for safe-haven assets. Gold's traditional safe-haven attributes have been fully demonstrated. Secondly, market disagreements persist regarding the future path of the Federal Reserve's monetary policy, and uncertainty remains. Although recent economic data shows resilience, whether inflation can successfully fall back to the target level remains unknown. This uncertainty weakens the attractiveness of dollar assets and enhances the allocation value of non-interest-bearing gold. Finally, the market points out that while the investigation into the Federal Reserve Chairman has drawn defenses from several central bank governors and bank executives, this matter, at a delicate moment, has still raised some concerns about central bank independence, indirectly benefiting gold.

Technically, gold has opened up new upward space after breaking through previous highs, exhibiting clear strength. The formation of the current historical high itself constitutes a technical breakout signal. For spot gold, $4600/oz has transformed from a strong resistance level into a key psychological support. Further support can be referenced at $4550/oz, the consolidation platform before the breakout. Since the price is at an absolute historical high, there are no obvious resistance levels to the upside, naturally bringing the next round number targets of $4650, $4700, and $4750 into view. However, profit-taking after extreme overbought conditions should be watched closely. During the trading session, key factors to watch include the US dollar index, changes in US Treasury real yields, and any unexpected geopolitical news. These will be crucial in influencing short-term gold price fluctuations.

Consider going long on spot gold around 4,606 today; Stop loss: 4,600; Target: 4,630; 4.640

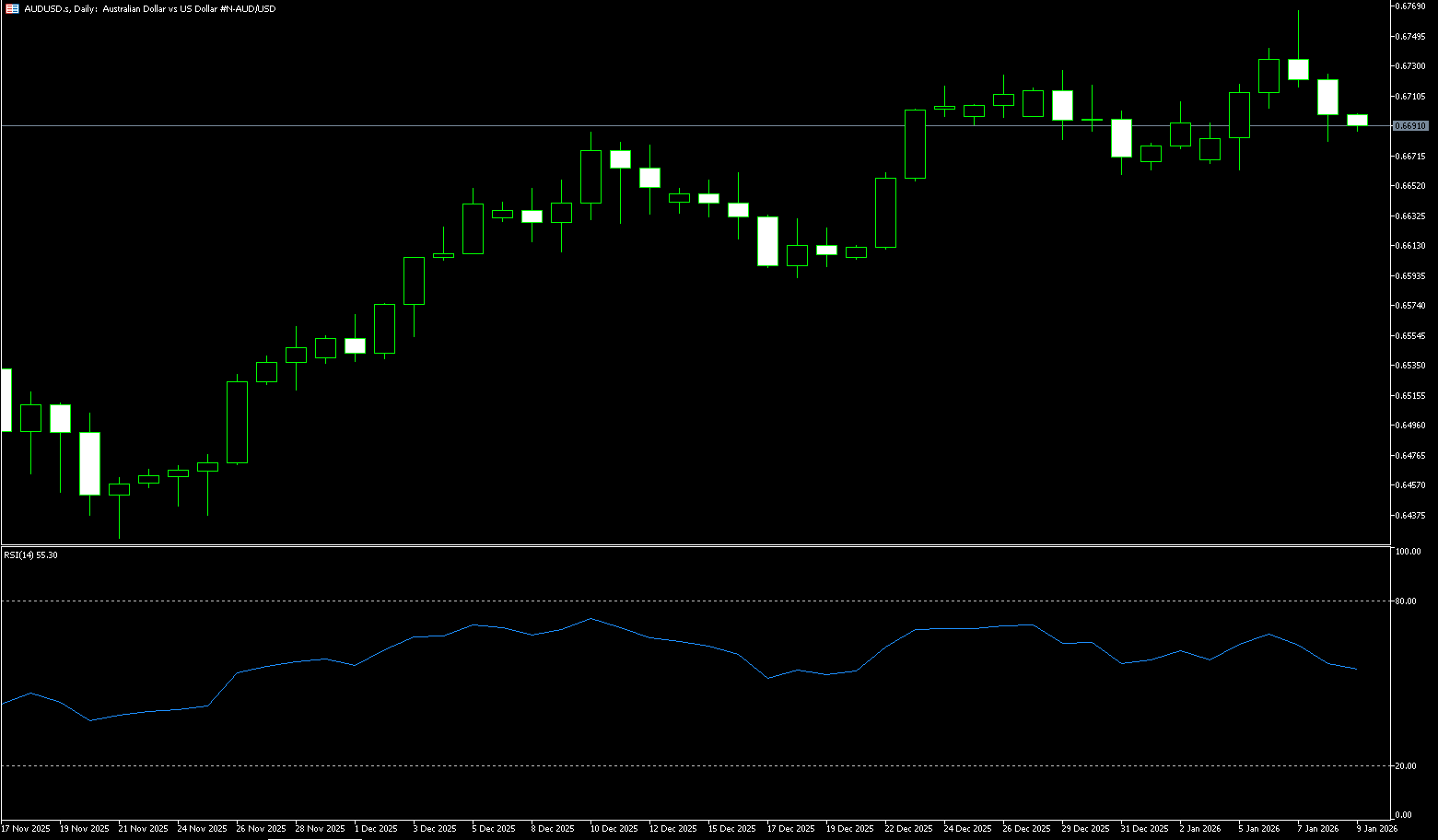

AUD/USD

In the Asian session on Thursday, the AUD/USD pair edged higher after a slight gain in the previous session, trading around 0.6698. The pair lost some gains after the release of Australian consumer inflation expectations. The January reading fell slightly to 4.6% from 4.7% in the previous month. The Reserve Bank of Australia kept the cash rate unchanged at 3.6% at its third consecutive meeting in December. Policymakers acknowledged that inflation has significantly retreated from its 2022 peak, although recent data suggests a renewed upward trend. Meanwhile, the US November producer price index was strong, with both the overall and core indicators reaching 3% year-on-year. This could provide support for the US dollar.

The Australian dollar traded in a range-bound manner against the US dollar this week, with intensified battles between bulls and bears. It fluctuated between 0.6660 and 0.6750. The upward trend structure remains intact, but upward momentum has weakened. Overall, it is slightly bullish but requires fundamental catalysts. The daily chart shows the price action supported by the short-term upward trend line, with the Bollinger Bands widening steadily. The middle band at 0.6690 serves as a key level for bulls and bears, indicating balanced short-term volatility. The RSI (14-day) has fallen from over 60 at the beginning of the week to 55, remaining neutral to slightly bullish and not overbought, suggesting weakening upward momentum but still bullish dominance. A break below 50 could lead to bearish dominance. The MACD lines remain in a bullish alignment, suggesting a possible short-term correction but the overall trend remains intact. The appearance of a green histogram would warrant caution regarding a potential trend reversal. If 0.6660 holds and the price breaks through and holds above the 0.6700 level (a psychological level), the initial target is the upper limit of 0.6766 in 2026, with further upside potential towards 0.6800 (a psychological level). If the price breaks below 0.6660 and fails to recover quickly, the next target is 0.6620-0.6650. A break below this level would open the way to 0.6600 (a psychological level).

Consider going long on the Australian dollar around 0.6686 today; Stop loss: 0.6674; Target: 0.6740; 0.6730

GBP/USD

Investor sentiment improved on Thursday due to a strong initial jobless claims report for the week ending January 10. The figure was 198K, lower than the expected 215K and significantly lower than the previous reading of 207K. Meanwhile, the New York Empire State Manufacturing Index improved to 7.7 in January from -3.7. At the same time, the Philadelphia Fed Manufacturing Survey also exceeded the expected -2, surging by 12.6. Following the data release, the US dollar rebounded, surging to a six-week high, as reflected in the US Dollar Index, which rose 0.33% to 99.38. Recently, Federal Reserve officials Rafael Bostic and Austan Goolsby gave speeches. Bostic stated that he expects the economy to grow by more than 2%, but anticipates persistent inflationary pressures, requiring the Fed to maintain a restrained stance. In the UK, economic growth in November exceeded expectations, but this did not change market expectations for a Bank of England rate cut.

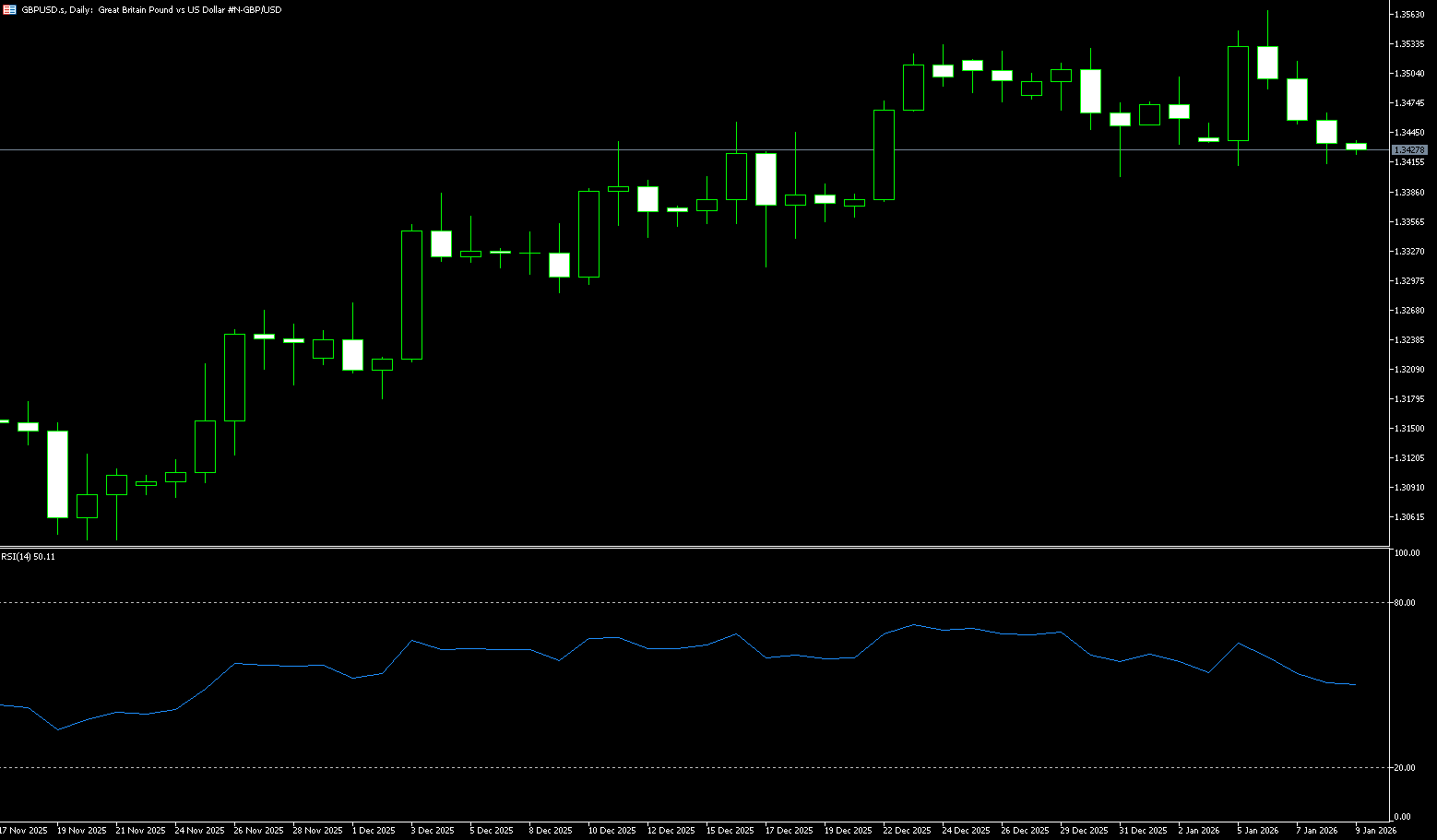

The GBP/USD daily chart shows the pair biased towards neutral. Momentum is also neutralizing, with the Relative Strength Index (RSI) hovering near neutral level {47}, slightly below the midline. For the bullish continuation to materialize, the pair must break above the January 13 high of 1.3494 to extend gains above the psychological level of 1.3500, with traders targeting the January 6 cycle high of 1.3567. A break above that level would then target 1.3600. Conversely, a break below 1.3400, with the 200-day simple moving average at 1.3404, would increase the selling pressure. A break below this level could exacerbate the decline towards the December 18th low of 1.3341. Then comes the 1.3300 psychological level.

Consider going long on GBP around 1.3365 today; Stop loss: 1.3353; Target: 1.3420; 1.3410

USD/JPY

The USD/JPY pair fell to around 158.60 in early Asian trading on Thursday. The yen rebounded against the dollar after Japanese officials warned of possible intervention to support the currency. Earlier this week, the yen fell on concerns about fiscal and monetary policy easing amid speculation that Prime Minister Fumio Kishida would call a snap election to consolidate his power. However, the downside for the yen may be limited due to concerns about intervention by Japanese authorities. Japanese Finance Minister Katayama reiterated his verbal warning on Wednesday that officials would take "appropriate measures to deal with excessive foreign exchange volatility, and no option is ruled out." US producer prices rose slightly in November, while US retail sales grew more than expected during the same period. Furthermore, data released last week showed that the US unemployment rate fell to 4.4% in December. These reports support the view that the Federal Reserve will keep interest rates unchanged in the coming months, which may provide some support for the USD/JPY pair.

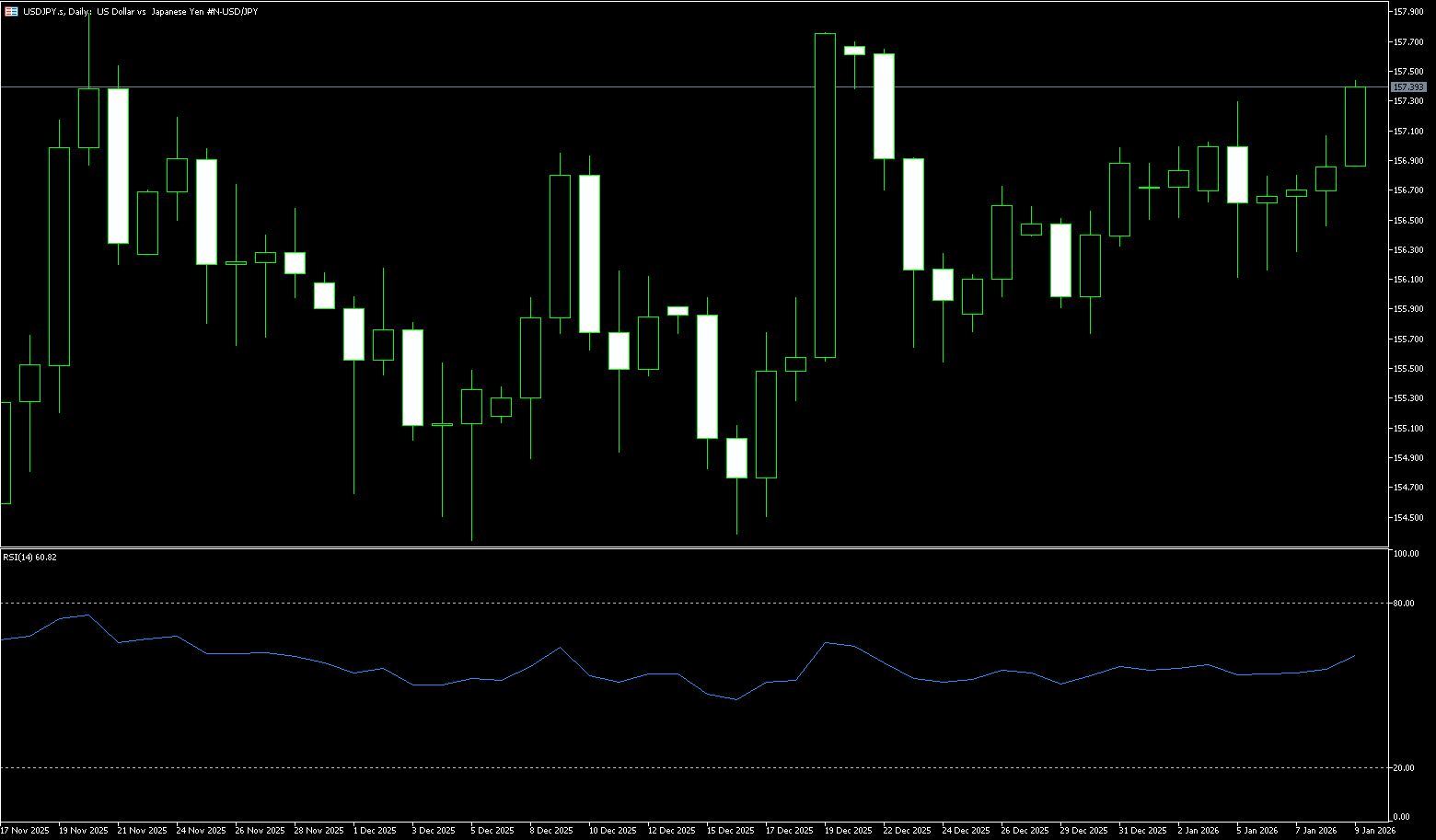

The yen rebounded from its lows against the dollar at midday on the weekday, coming within a hair's breadth of the market's closely watched 160 target, as the dollar's rise weakened. The pair has retreated from its two-year high of 159.45, returning to near the middle of the 158.00 range. Currently, short-term depreciation pressure on the yen has not yet dissipated, and it is only a matter of time before the USD/JPY breaks through the 160 level. However, its subsequent movement will be highly dependent on Japan's political developments and intervention decisions—this currency market shift, driven by policy contradictions, political games, and geopolitical risks, continues to unfold. Technically, the USD/JPY is challenging the upper rail of a large upward channel. Although this challenge failed, the pair remains above the 5-day moving average. As long as the 5-day moving average holds, the USD/JPY remains in a very strong range. Resistance levels are at this week's high of 159.45 and the psychological level of 160, while support is at the 9-day moving average of 157.65 and near the psychological level of 157.00.

Consider shorting the US dollar today near 158.80; Stop loss: 158.95; Target: 157.80, 157.70

EUR/USD

The euro continued to fall against the dollar, trading at $1.1605, after earlier falling to 1.1593, its lowest level in over a month, as investors weighed economic data from the eurozone and the US, along with divergent central bank policies. The German economy grew by 0.2% in 2025, ending two years of contraction, supported by household and government consumption, although weakness in manufacturing made the outlook fragile. Eurozone inflation slowed to 2.0% in December, returning to the ECB's target and reinforcing expectations that interest rates will remain unchanged. European Central Bank member François Villeroy de Gallo called expectations of a 2026 rate hike "wishful thinking" this week. In the US, stronger-than-expected retail sales supported the dollar, despite earlier data showing lower-than-expected inflation.

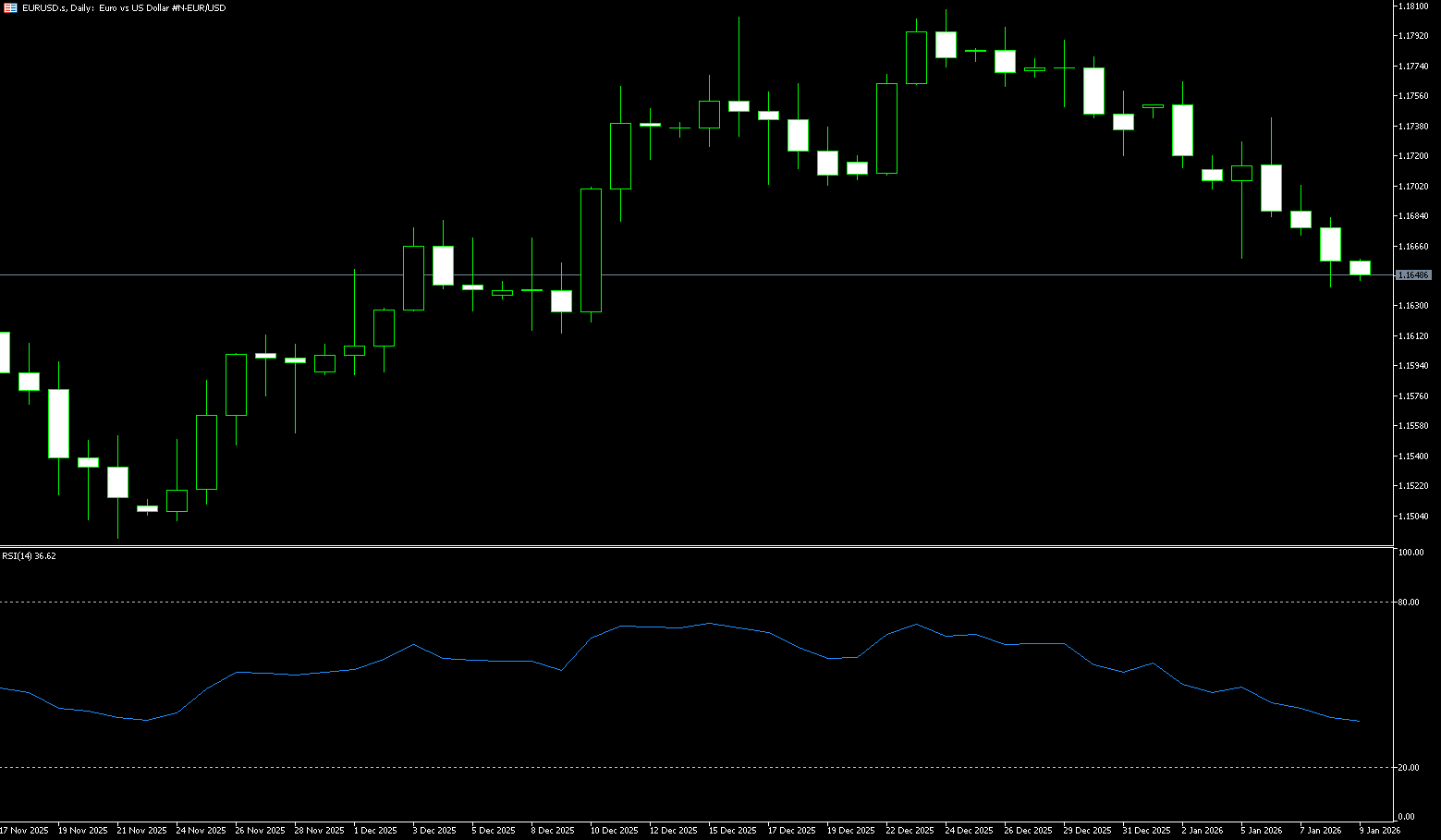

Technically, EUR/USD is neutral to bearish. The 4-hour chart shows a slightly bearish 20-period moving average continuing to decline below the 200 and 100-period simple moving averages, while the pair remains below all three moving averages, maintaining a bearish tone. The 20-period simple moving average at 1.1644 acts as immediate dynamic resistance. Meanwhile, the momentum indicator accelerated downwards after breaking through the midline, and is below the neutral line and continuing to decline, consistent with increasing bearish pressure. The Relative Strength Index (RSI) is hovering around 34.86, indicating weak buying interest and a lack of speculative activity. A break above the 20-period simple moving average at 1.1644 could open up space for the psychological level of 1.1700 and the 1.1765 (this year's high). Conversely, a close below 1.1600 would expose further downside risk to the 1.1583 (200-day simple moving average) and 1.1547 (last November 26th low) area.

Consider going long on the Euro today near 1.1600; Stop loss: 1.1586; Targets: 1.1640, 1.1650

Disclaimer: The information contained herein (1) is proprietary to BCR and/or its content providers; (2) may not be copied or distributed; (3) is not warranted to be accurate, complete or timely; and, (4) does not constitute advice or a recommendation by BCR or its content providers in respect of the investment in financial instruments. Neither BCR or its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

More Coverage

Risk Disclosure:Derivatives are traded over-the-counter on margin, which means they carry a high level of risk and there is a possibility you could lose all of your investment. These products are not suitable for all investors. Please ensure you fully understand the risks and carefully consider your financial situation and trading experience before trading. Seek independent financial advice if necessary before opening an account with BCR.

BCR Co Pty Ltd (Company No. 1975046) is a company incorporated under the laws of the British Virgin Islands, with its registered office at Trident Chambers, Wickham’s Cay 1, Road Town, Tortola, British Virgin Islands, and is licensed and regulated by the British Virgin Islands Financial Services Commission under License No. SIBA/L/19/1122.

Open Bridge Limited (Company No. 16701394) is a company incorporated under the Companies Act 2006 and registered in England and Wales, with its registered address at Kemp House, 160 City Road, London, City Road, London, England, EC1V 2NX. This entity acts solely as a payment processor and does not provide any trading or investment services.