0

US Dollar Index

The US dollar index fell for the fourth consecutive trading day on Tuesday, slipping to 95.58, its lowest level since February 2022, as investors positioned themselves ahead of the Federal Reserve's monetary policy decision on Wednesday. The market widely expects the central bank to keep interest rates unchanged, although concerns about its independence being under political pressure remain a major concern. Speculation intensified that a new Fed chair might be announced earlier this week, with President Trump widely seen as likely to nominate a more moderate candidate. The dollar was also pressured by renewed concerns about a government shutdown, with Democratic leaders threatening to block the $1.2 trillion funding package if it includes additional funding for homeland security. This added pressure to the dollar in a broader "sell America" trade, while speculation also intensified about possible joint US-Japan intervention to curb further losses in Japanese bonds and support the yen.

A weaker dollar is beneficial to almost all asset classes, especially minor metals and precious metals. However, given the long-term weakening trend coupled with short-term oversold conditions, it may be necessary to pay more attention to short-term clues related to the US dollar index. The rhetoric of selling the US dollar has been intensifying recently, but the main reason for the dollar's decline in the last two trading days is still the recent concerns about foreign trade and the impact of the Japanese yen. Technically, the dollar index has fallen into a key support zone, and it is highly likely that the dollar index will rebound after a period of consolidation. Support levels are at 95.14 (February 2022 low) and 9500 (psychological level). Resistance levels are near 96.22 (September 2025 low) and 97.00 (psychological level).

Today, consider shorting the dollar index near 95.90; stop loss: 96.05; target: 95.30; 95.40

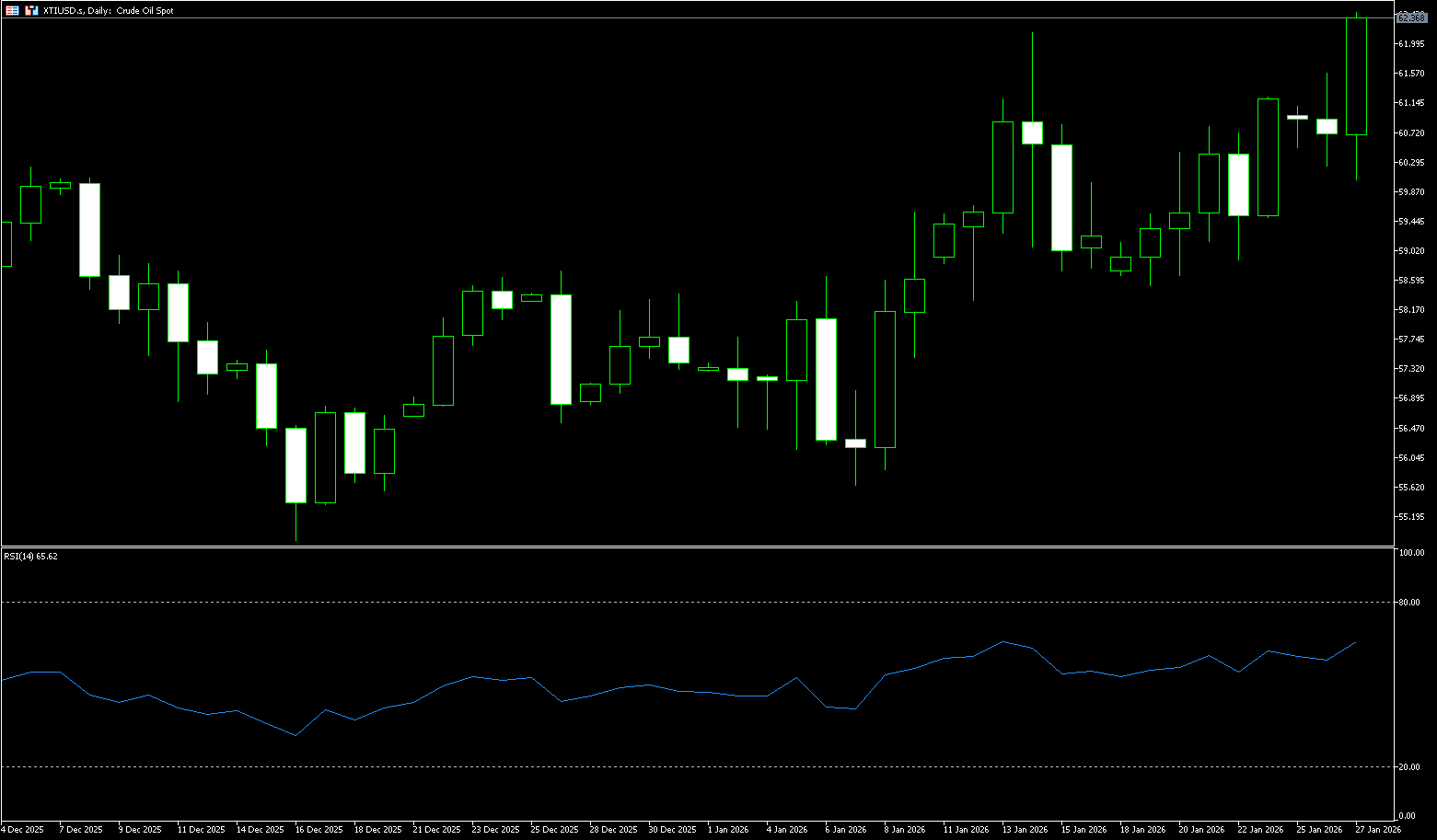

WTI Crude Oil

WTI crude oil futures rose about 2% on Tuesday to $62.50 a barrel, after falling 0.7% on Monday. U.S. oil producers lost up to 2 million barrels per day of output over the weekend, or about 15 percent of national production, as severe winter storms disrupted crude oil production and refining operations. Several refineries along the U.S. Gulf Coast also reported weather-related problems, increasing concerns about short-term fuel supplies and potentially leading to inventory depletion if the cold weather persists. Geopolitical risks remain a concern as tensions continue to escalate with the deployment of a U.S. aircraft carrier and its support vessels to the Middle East. On the other hand, supply concerns were partially offset by expectations of increased production in Kazakhstan, as production preparations at the Tengi oil field resumed and the CPC pipeline returned to full-capacity, while OPEC+ is expected to maintain current production levels at its upcoming meeting.

Overall, WTI crude oil prices could potentially reach $65 as speculators are forced to unwind short positions, tensions in Iran, the impact of extreme cold weather, and continued crude oil demand from China and India. Furthermore, the gradual recovery of Venezuelan crude oil supplies and the reduction in floating storage are easing pressure on "surplus" crude oil. Investors should closely monitor inventory data and geopolitical risks, and adjust their trading strategies flexibly. The current trading strategy is as follows: if the price breaks below $60.00 (a psychological level), the next key support level is $58.50. A break below this level could accelerate the decline to the $57 mark. If the price rises, the next target is $62.68 (the high from last October). Strong resistance is at the $63.00 level (a psychological level).

Today, consider going long on crude oil around $62.14; stop loss: $62.00; target: $63.50; $64.00

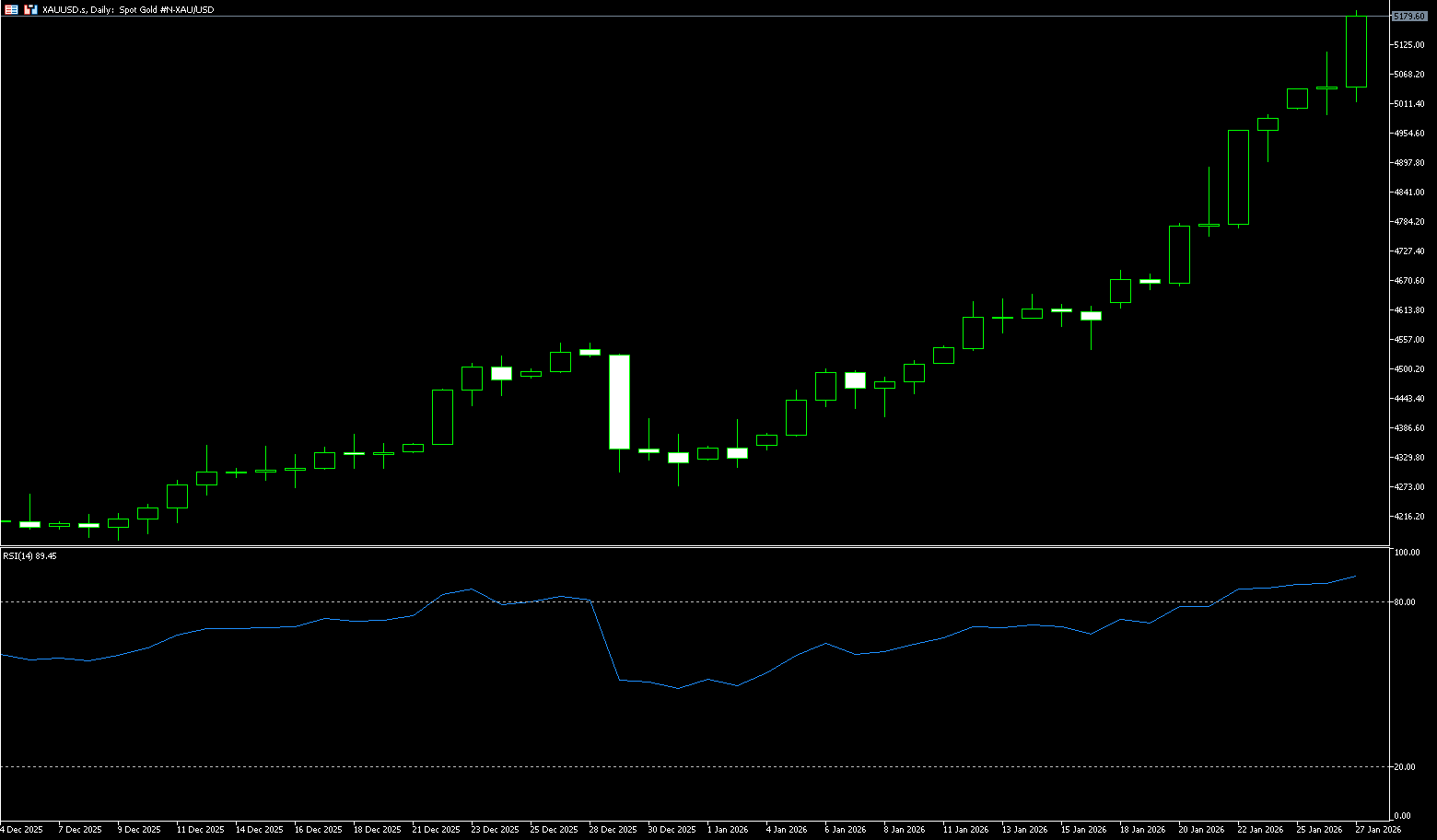

Spot Gold

At the beginning of the week, international gold prices exceeded expectations and continued their strong performance, opening 0.49% higher and then surging more than 3%, successfully breaking through the $5,000 per ounce mark. It briefly rose to $5,188, setting a new historical high, and is currently trading around $5,170. After a strong finish to 2025, gold's upward momentum continues, with a year-to-date gain of approximately 20%, making it a standout performer in global financial markets and a core target for safe-haven investment, consistently achieving record-breaking gains. In summary, this round of gold price increases is driven by three main factors: geopolitical risks, policy uncertainty, and a weak dollar. In the short term, if the Federal Reserve releases hawkish signals or market sentiment temporarily recovers, gold prices may experience increased volatility or even a pullback. However, as long as global uncertainty remains largely unresolved and easing expectations are not disproven, gold is expected to maintain its overall upward trend.

Technically, spot gold prices have followed a parabolic upward trend, reaching a historical high of $5,188 before retreating to $5,170, a gain of over 2%. The precious metal rose nearly 20% in the first month of the year and is poised to extend its gains to $5,250. The initial gold price forecast update indicated a target of $5,250, followed by $5,500. Gold prices have moved significantly away from the 5-day moving average, creating a need for correction. If the US dollar index rebounds sharply or there is an unexpected easing of geopolitical tensions, gold prices may retrace to the gap around 5,000 or 4,932. A return to the gap, which is also near the 5-day moving average, could trigger a strong rebound.

Today, consider going long on gold around 5.173; Stop loss: 5.168; Target: 5,250; 5,270

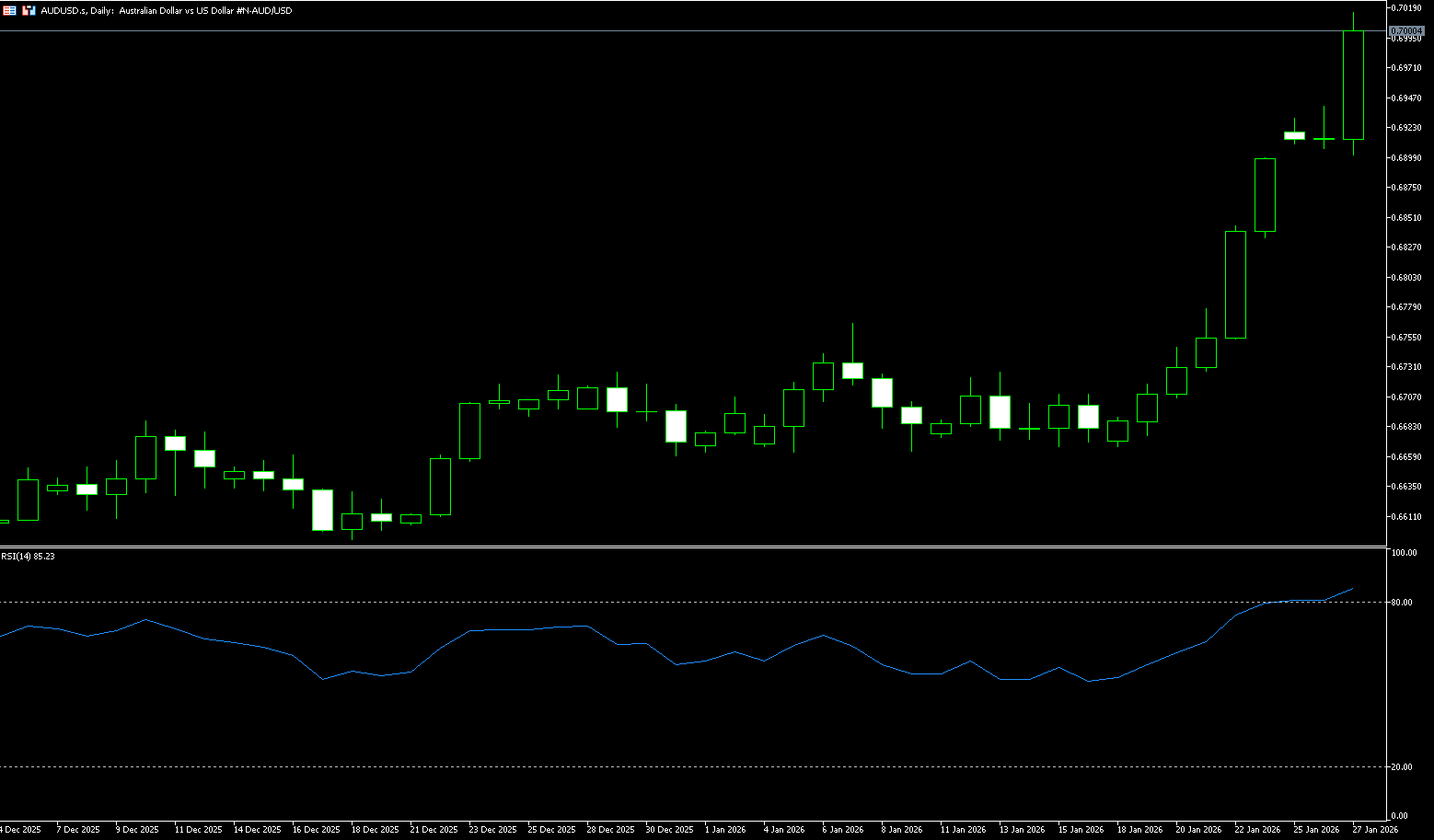

AUD/USD

The AUD/USD pair rose further, breaking through the key 0.7000 barrier. The pair's strong gains are in response to the continued sharp decline in the US dollar amid generally risk-averse sentiment. Looking ahead, domestic investors are expected to closely watch Australian inflation data released on Wednesday. Supported by attractive high yields, Australian government bond yields have become increasingly attractive, with policy-sensitive three-year bonds climbing to their highest level since November 2023, reflecting investor confidence in Australia's top credit rating and the central bank's hawkish policy outlook. Domestic economic data further strengthened the case for an interest rate hike, as the unemployment rate unexpectedly fell to a seven-month low in December. The focus now shifts to key inflation data due on Wednesday, with investors closely watching the December monthly Consumer Price Index and the revised fourth-quarter mean index, the latter widely seen as a measure of underlying price pressures favored by the Reserve Bank of Australia.

The bullish trend in AUD/USD currently appears unstoppable. Meanwhile, momentum indicators appear bullish, but caution is warranted: the Relative Strength Index (RSI) remains in clearly overbought territory near 84, while the Average Directional Index (ADX) above 40 indicates a strong trend. However, as the pair moves further into overbought territory, the idea of a technical correction is expected to gain traction. The next target is the 0.7000 level, and a break above this level would present the next relevant hurdle at the week's high of 0.7157 (February 2nd). Regarding the possibility of a correction, the current low of 0.6901 (Tuesday's low) has become a direct target. From there, the next support level is 0.6800 (a psychological level).

Consider going long on the Australian dollar around 0.6995 today; Stop loss: 0.6980; Target: 0.7040; 0.7050

GBP/USD

The GBP/USD pair extended its gains in early European trading on Tuesday, approaching 1.3870, its highest level since September 17, 2021. This was due to the continued weakening of the US dollar amid escalating trade tariffs, ahead of the first Federal Reserve monetary policy meeting in 2026. As of this writing, the GBP/USD is trading at 1.3850, up 0.76%, after previously hitting a four-year high of 1.3791. The pound rose slightly against the dollar due to stronger-than-expected UK retail sales and purchasing managers' index data. These optimistic reports have led some analysts to predict that the Bank of England may postpone further interest rate cuts. On the dollar front, concerns about the independence of the Federal Reserve and fears of another US government shutdown could put pressure on the dollar. US President Donald Trump is likely to announce the name of the next Federal Reserve chairman in January. Traders are concerned that the US central bank will lose its independence following the appointment of a Trump candidate as Federal Reserve chair. Traders will be closely watching the Fed press conference following the policy meeting, as it could provide crucial clues for the coming months. Any hawkish comments from Fed officials could support the dollar and put downward pressure on major currency pairs.

During Tuesday's North American session, the pound surged while the dollar continued to weaken. As of this writing, GBP/USD is trading at 1.3850, up 0.76%, after hitting a four-year high of 1.3870. Prices are testing this dynamic upper limit. A close above this level would improve short-term momentum. The 14-day Relative Strength Index (RSI) is slightly overbought at 71, but still reflects balanced momentum. Initial resistance is seen in the 1.3900 (psychological level) – 1.3913 (September 2021 high) range. Failure to break through this area could see the pair re-enter the 1.3957 (August 2021 high) consolidation range. Support lies around the 1.3800 level; a break below this level could trigger a more significant pullback to 1.3713 (Monday's low).

Consider going long on GBP/USD today around 1.3838; Stop loss: 1.3825; Targets: 1.3900, 1.3950

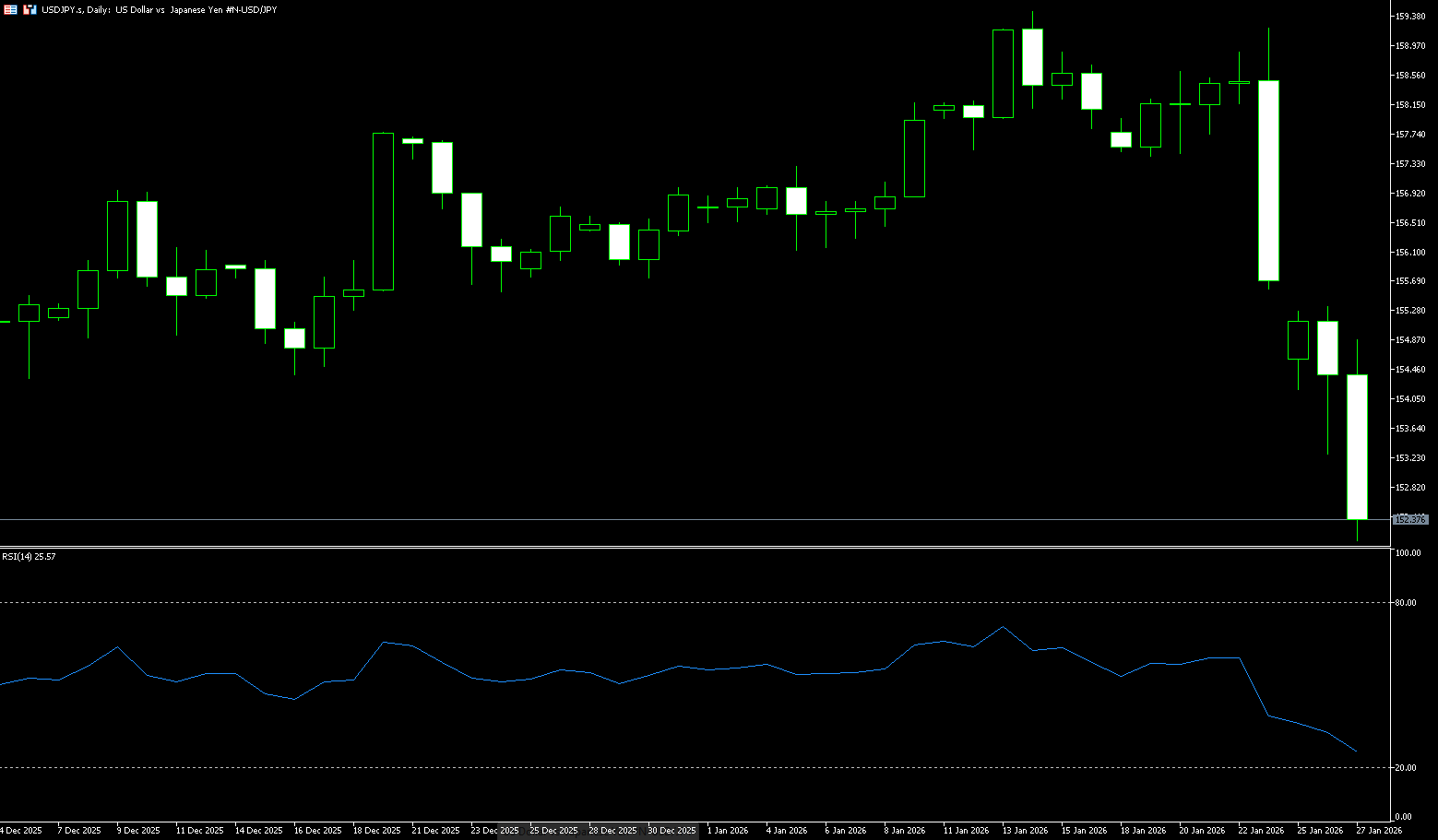

USD/JPY

USD/JPY remains weak below 154.00 after being rejected at 154.85. Rising US trade uncertainty and the risk of a government shutdown are putting pressure on the dollar. The yen traded near 152.15 per dollar on Tuesday, rising 1.23% before experiencing sharp fluctuations due to heightened concerns about potential coordinated intervention in the foreign exchange market by Tokyo and Washington. Friday's news triggered the volatility, with the New York Federal Reserve conducting an interest rate check on USD/JPY, while Japanese officials stated they were closely coordinating with the US on monetary policy and potential market intervention. Meanwhile, data from the Bank of Japan suggests that Friday's sudden rise in the yen was unlikely due to official intervention. The local currency also benefited from the general weakness of the US dollar, which was driven by escalating geopolitical and trade risks, as well as market expectations that US President Donald Trump would soon replace Federal Reserve Chairman Jerome Powell with a more moderate candidate, thus putting additional downward pressure on the dollar.

From a technical perspective, a sustained break and acceptance below the 154.00 support level, and a move towards the 152 psychological level, the highest point since last October, would be seen as a new trigger for USD/JPY bears. Momentum has deteriorated as the MACD indicator has fallen below zero and declined further, suggesting increasing bearish pressure. The 14-day Relative Strength Index (RSI) is at 25, in oversold territory, indicating that downward momentum has extended to 150.47 (the low of October 21st last year) and 150 (the psychological level). If buyers break above 153.00 (the psychological level), they will retest the 100-day simple moving average at 153.79, and the 154.00 support level.

Today, consider shorting the US dollar near 152.43; Stop loss: 152.60; Target: 151.40; 151.00

EUR/USD

The EUR/USD pair continued its upward trend, breaking through the key 1.2000 area and reaching its highest level since June 2021. The latest gains reflect continued selling pressure on the dollar, with the overall risk environment remaining supportive as investors again focus on tariff-related risks from the White House. The euro broke through 1.20, reaching its highest level since June 2021, as the dollar extended last week's losses ahead of heightened market caution regarding potential Japanese intervention in the yen and the Fed's policy announcement on Wednesday. While the market widely expects the Fed to keep interest rates unchanged, investors are closely watching its guidance for clues about the timing of the next rate cut, with speculation that a more dovish successor to Fed Chairman Jerome Powell may be appointed this week. Meanwhile, investors remain wary of escalating geopolitical and trade tensions. US President Donald Trump initially threatened several countries with new tariffs as part of efforts related to Greenland, but changed his stance after announcing a framework agreement for a future deal. He also warned that the US might impose 100% tariffs on Canada if it reaches a trade agreement with China.

The euro/dollar is experiencing a sustained rally on optimism, breaking through the key 1.2000 area while reaching its highest level since June 2021. The euro/dollar maintains a solid upward bias, trading at levels last seen in the summer of 2021, while focusing attention on the key 1.2000 threshold. The moving average convergence/divergence (MACD) histogram remains positive but has contracted from recent highs, and the relative strength index (RSI) remains above 78, consistent with a bullish trend. The pair has risen into the upper range above 1.200, and on the upside, the area between the September 2020 high of 1.2113 and the psychological level of 1.2100 could provide significant resistance. Further upside, the September 2020 high of 1.2150 is a potential target. The first key support level for EUR/USD is 1.1900 (the psychological level), which could pave the way for a test of 1.1850 (Tuesday's low).

Consider going long on EUR/USD today near 1.2020; Stop loss: 1.2010; Targets: 1.2080, 1.2090

Disclaimer: The information contained herein (1) is proprietary to BCR and/or its content providers; (2) may not be copied or distributed; (3) is not warranted to be accurate, complete or timely; and, (4) does not constitute advice or a recommendation by BCR or its content providers in respect of the investment in financial instruments. Neither BCR or its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

Lebih Liputan

Pendedahan Risiko:Instrumen derivatif diniagakan di luar bursa dengan margin, yang bermakna ia membawa tahap risiko yang tinggi dan terdapat kemungkinan anda boleh kehilangan seluruh pelaburan anda. Produk-produk ini tidak sesuai untuk semua pelabur. Pastikan anda memahami sepenuhnya risiko dan pertimbangkan dengan teliti keadaan kewangan dan pengalaman dagangan anda sebelum berdagang. Cari nasihat kewangan bebas jika perlu sebelum membuka akaun dengan BCR.

BCR Co Pty Ltd (No. Syarikat 1975046) ialah syarikat yang diperbadankan di bawah undang-undang British Virgin Islands, dengan pejabat berdaftar di Trident Chambers, Wickham’s Cay 1, Road Town, Tortola, British Virgin Islands, dan dilesenkan serta dikawal selia oleh Suruhanjaya Perkhidmatan Kewangan British Virgin Islands di bawah Lesen No. SIBA/L/19/1122.

Open Bridge Limited (No. Syarikat 16701394) ialah syarikat yang diperbadankan di bawah Akta Syarikat 2006 dan berdaftar di England dan Wales, dengan alamat berdaftar di Kemp House, 160 City Road, London, City Road, London, England, EC1V 2NX. Entiti ini bertindak semata-mata sebagai pemproses pembayaran dan tidak menyediakan sebarang perkhidmatan perdagangan atau pelaburan.